Global Sector Analysis on 871620290, 1144409997, 965465148, 18007457354, 946941310, 1904211346

The examination of sector codes 871620290, 1144409997, 965465148, 18007457354, 946941310, and 1904211346 reveals distinct performance patterns and profitability levels across various industries. Each sector is influenced by emerging technologies and sustainability initiatives, which are redefining traditional market frameworks. Understanding these dynamics is crucial for stakeholders aiming to navigate the complexities of today’s economic landscape. However, what specific strategies can investors employ to effectively capitalize on these evolving trends?

Overview of Sector Codes and Their Significance

Sector codes serve as a crucial framework for categorizing and analyzing various industries within the global economy.

This sector classification facilitates a deeper understanding of market dynamics and consumer behavior, leading to informed decision-making.

Additionally, the economic implications of these classifications are significant, as they enable stakeholders to identify trends, allocate resources effectively, and assess the potential risks and opportunities within diverse sectors.

Performance Analysis of Selected Sectors

Examining the performance of selected sectors reveals significant variations in growth trajectories and profitability metrics across the global landscape.

Sector performance is intricately linked to evolving market dynamics, with some sectors experiencing robust expansion while others face stagnation.

Key indicators, including revenue growth and return on investment, highlight these disparities, underscoring the necessity for stakeholders to adapt strategies in response to shifting economic conditions.

Emerging Trends and Market Opportunities

What factors are driving the emergence of new trends and market opportunities across various industries?

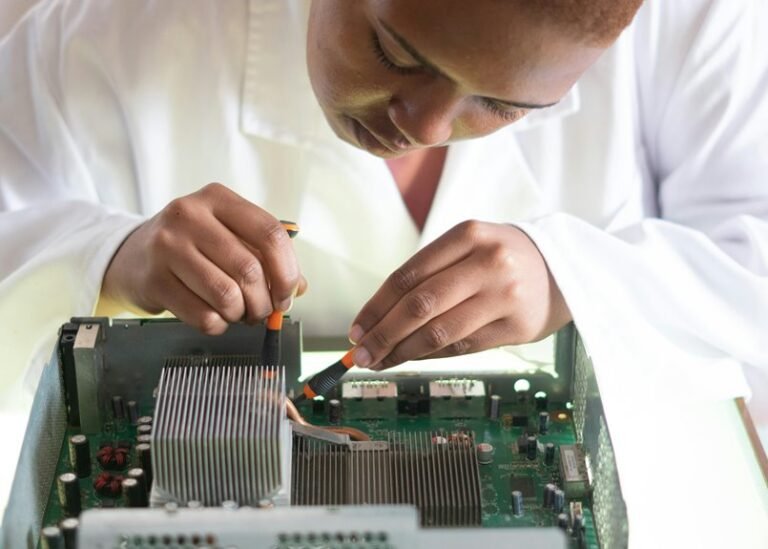

The rise of emerging technologies, such as artificial intelligence and blockchain, is catalyzing market expansion.

Additionally, consumer demands for sustainability and personalization are reshaping product offerings.

Companies adapting to these innovations position themselves strategically, harnessing data-driven insights to explore untapped markets and meet evolving consumer expectations.

Strategic Insights for Investors and Business Owners

How can investors and business owners effectively navigate the complexities of today’s dynamic market landscape?

Strategic investment strategies must encompass robust risk management and sector diversification, adapting to shifting market dynamics.

Employing comprehensive financial forecasting and competitive analysis will empower stakeholders to identify opportunities and mitigate threats, ultimately fostering resilience and promoting sustainable growth in an increasingly volatile environment.

Conclusion

In summation, the intricate tapestry of sectors represented by the identified codes reveals a landscape rich with potential yet fraught with challenges. As emerging technologies and sustainability reshape market norms, stakeholders find themselves at a crossroads, where prudent navigation and informed decision-making become paramount. By embracing adaptive strategies and harnessing data-driven insights, investors and business owners can illuminate pathways to growth, transforming uncertainty into opportunity amid the ever-evolving economic horizon.